Artificial Intelligence aims to become a major player in the future of financial technology. As investments start to count more and more billions and FinTech startups are about to see some success, the general proliferation of the artificial intelligence in the financial industry is inevitable.

A survey realized by Euromoney Institutional Investor Thought Leadership, on a sample of 424 executives from the financial services area, revealed that seven out of ten respondents consider AI will impact largely or their jobs in the future.

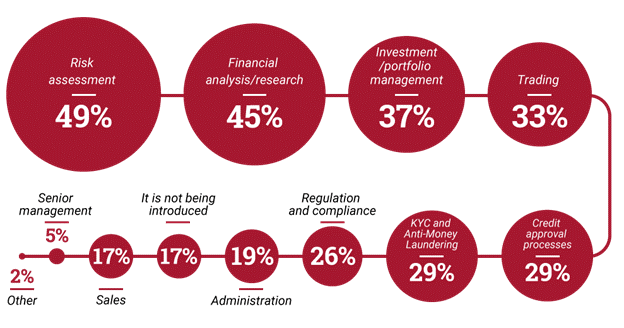

Survey: Areas of the company where AI is expected to be introduced. Source: “Ghosts in the Machine,” report of Euromoney Institutional Investor Thought Leadership

AI uses sophisticated technology, based on data sets and algorithms, to replace human decision making. Artificial Intelligence is far more than automation; it accomplishes a judgment based task that incorporates machine learning and complex algorithms to make decisions and forecast future outcomes.

Cutting edge technology translates into competitive advantage. Some potential uses of AI in the financial industry might be:

Better Decision Making

Management decisions based on data will employ machines that analyze data and produce recommendations, instead of consulting human experts. Introducing machines is expected to lower costs and improve quality of decisions.

Forecasts Analysis

Useless to stress the importance of forecasts and predictions in the financial industry. They impact just about everything from strategy to revenues. Analytics and projections gather and analyze massive quantities of data through tailored algorithms and deploy customized unique solutions for customers. Predictive analytics scope is to forecast customer behavior based on historical data, data mining and advanced statistics. Calculating credit score is such a situation.

Identifying Frauds and Claims Management

Besides collecting and analyzing data, artificial intelligence tools can learn and identify behavioral patterns to depict fraud attempts and potential incidents. Leveraging the benefits of AI, together with managing large amounts of data in short periods of time can improve the claims management process. All these while reducing costs, shortening processing time and ameliorating the customer experience.

Automated Customer Service

Again, for costs considerations, human customer support may be replaced with automated text chats, chatbots or voice systems to deliver expert advice or support. RBS has developed a technology called Luvo, to assist IT agents in finding the right answers to customer queries.

Virtual Expert Advisors

These apps are automated assistants and planners that help users with their financial decisions. They monitor current events, financial markets trends and make recommendations according to the user’s requirements and portfolio preferences. Such an example is Wealthfront

Thus, some concerns

New technology in finance and particularly AI promise great opportunities, but their integration should be carefully managed. And challenges overcame otherwise we just might increase risks.

Increased AI capabilities mean fewer jobs. Some may argue that the human intuition has its role in the risk assessment and AI cannot incorporate it.

Also, it might difficult sometimes to understand the outcomes delivered by the technology. It’s unclear in some cases how the machine intelligence work, in case some problems occur, we would not be able to outline a solution.

Considering that computers are entirely objective might be a trap. The truth is that AI encapsulates human biases, so, it might as well permanently codify human errors and biases.

Computer artificial intelligence is no longer a science fiction subject; it is real, it is here to say and now is an accelerating mood. It promises remarkable opportunities to expand skills, diminish costs and improve the user experience. And it’s the job of the financial technology firms to implement it safely and ethically. While we are living the age of AI, the humanity is not exactly ready to work on auto-pilot.